Saving vs Investing.

Saving vs Investing: What are the key differences?

Saving vs Investing: What are the key differences?

Wondering if you should save or invest with your spare cash? Saving and investing are both important tools you can use to help you reach your financial goals. Saving is putting money in a safe place to use soon, whereas investing is putting your money to work in the hopes you’ll have more later.

Below, we’ll explain saving and investing in detail, the key differences between them and how you can decide which is right for you. But bear in mind that this article isn’t a substitute for personalised financial advice; you should seek guidance from a professional if you’re not sure which option is best for you.

What is saving?

Saving is when you put aside some of your money for future use instead of spending it, typically using a savings account with a bank or building society. You can save your money in one-off amounts or make regular deposits into a savings account, and you’ll typically earn a small amount of interest.

Saving is generally a low-risk way to store your spare money. UK banks and building societies are regulated by the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 of your savings* if your bank or building society goes bust.

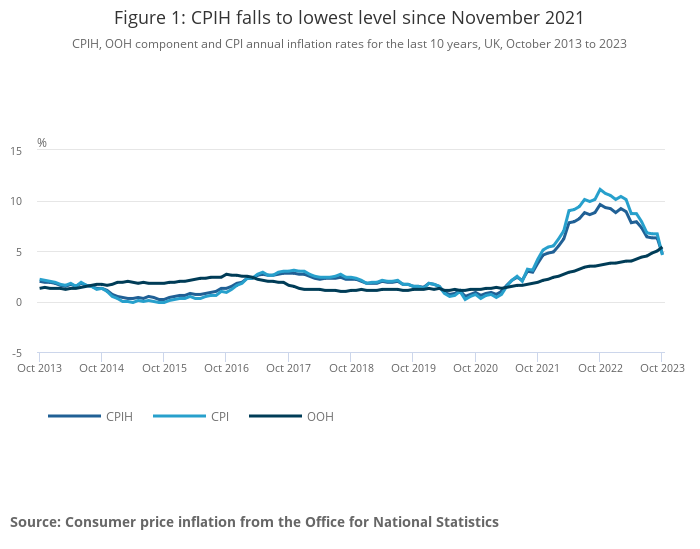

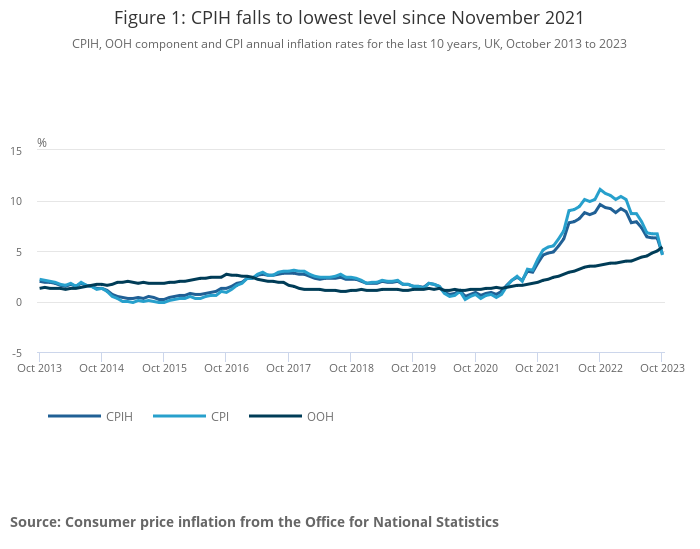

Yet saving isn’t completely risk-free because of inflation, represented by the Consumer Prices Index**. This is the rate at which the price of goods and services is increasing. If the prices of goods and services go up, then a given amount of money has less ‘buying power’. This effectively means that your savings are worth less than they were when you stashed them away.

The only way to beat inflation is if your money is earning interest at a rate that is greater than or at least matches the rate of inflation. This means there’s a risk your money is slowly losing its value if your savings account earns a lower interest rate.

What is investing?

Investing involves setting aside your money for the future, aiming to make a profit over a longer period. You can invest your money using different financial assets like shares or bonds, or with a ready-made fund that’s managed by experts.

Investing typically involves more risk than saving, as your money is exposed to the volatility of the financial markets you invest in. The value of your investments will jump around. Yet this doesn’t just mean there’s potential for greater returns but also that you could get back less money than you put in – especially if you withdraw your investment within a short period of time.

That being said, the potential ups and downs of the market have been proven to balance out over longer periods. While there’s no way to guarantee good results, there are clever risk management strategies such as portfolio diversification that can improve your chances.

Different ways to invest your money

There are a wide range of asset classes you can invest in, each with its pros and cons. Here are some of the main ways you can invest your money:

- Stocks – You buy a part of a company and get a share in its financial performance. You earn money through the stock price rising or if the company pays out regular dividends from its profits.

- Bonds – You buy a share of a company or government’s debt over a fixed term, entitling you to receive periodic interest payments and the face value of the bond when the term ends.

- Investment funds – Funds are collective investments you make with other investors. You pool your money together and spread it across a range of assets to reduce risks. Some funds are managed by financial experts and some passively track indices. There are different types of funds, including mutual funds and exchange-traded funds (ETFs).

Opening a Stocks and Shares Individual Savings Account (ISA) can be a simple way to start investing. This type of account allows you to invest up to £20,000 each year in a wide range of investment products such as stocks, bonds and exchange-traded funds without any earnings you make being subject to income or capital gains tax.

Key differences between investments and savings

- Potential returns – Savings accounts tend to have lower interest rates, so they don’t give you much opportunity to earn. Investments give you more potential for growth but good performance is never guaranteed.

- Risk profile – The main risk with saving is that your money will slowly lose buying power over time. However, there’s a risk of you losing money with investing.

- Ideal timeframe – Savings are less likely to beat inflation over the long term but investments might experience volatility over the short term.

- Expertise – You don’t need any financial expertise to save but you should seek advice when choosing appropriate investments and employing risk-management strategies. A financial expert can also help you decide whether saving or investing is right for you.

Should I save or invest?

Unfortunately, there’s no one-size-fits-all answer. Whether you should put your money into investments or savings depends on your circumstances, such as how much cash you have available, how old you are and how much risk you’re willing to tolerate. It also depends on whether the timeframe for your financial goals is short, medium or long-term.

When should I save?

Putting your money away in a savings account could be a good option if:

- You’re aiming at a short-term goal, such as a holiday, wedding or house purchase

- You want to build a safety net you can dip into in case of emergencies

- You want to be able to access your money whenever you want

- You don’t want to lose money, but are happy for inflation to erode your savings’ buying power

- Your savings account has a high enough interest rate that you can get a good return with minimal risk

The only time it might not be advisable to save is if you have high debts you need to pay off, as debts tend to accrue much more interest than savings earn. In this case, though, investing probably shouldn’t be your priority, . Consult a financial adviser for professional expertise that is best suited to your unique circumstances.

When should I invest?

Investing could be a good option for you if:

- You’re aiming for long-term financial goals

- You aren’t likely to need the money for 5-10 years

- You’re prepared to ride out any market volatility

- You can find investments that meet your risk appetite

- You’re a high earner and could use specific types of investments to get tax relief

We’re here to help you save or invest

Saving and investing both play a crucial role in building your financial future. In the end, though, neither is enough on its own. That’s why it can help to use a mix of both, saving for what’s around the corner and investing for your long-term future.

It’s important that you get financial advice if you’re in any doubt about how you can get the most out of your money. Feel free to contact us with any questions you have about investments or savings, and we’ll be happy to help.

With investing, your capital is at risk. Investments can fluctuate in value, and you may get back less than you invest. Tax is subject to an individual’s personal circumstances, and tax rules can change at any time. This blog is for information only and is not personal financial advice.

Sources:

* https://www.fscs.org.uk/industry-resources/deposit-protection-banks/

Accessed 09/04/24

**https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/october2023

Accessed 09/04/24 (Chart also sourced from here)

Back to blog

Saving vs Investing: What are the key differences?

Saving vs Investing: What are the key differences?